A CBDCs Discussion — Benkiko Finance

A CBDCs Discussion — Benkiko Finance

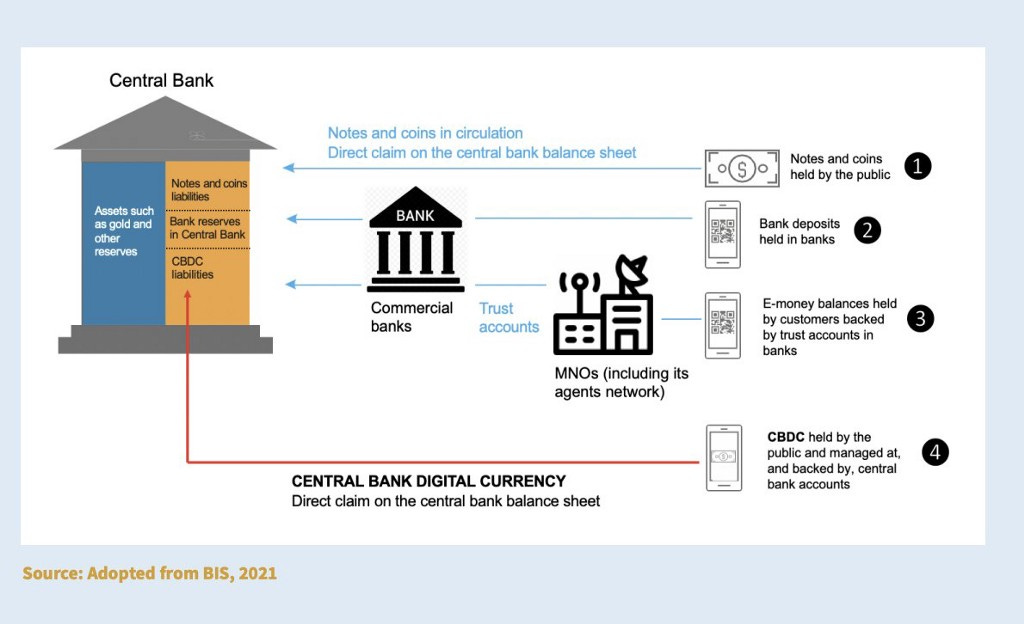

Central Bank Digital Currencies (CBDCs) are digital payment tokens issued by a central bank. The majority of banks across the world are now actively considering CBDCs. It may well be argued that CBDCs are the Fiat System’s response to the ongoing cryptocurrencies revolution.

The intention is that CBDCs have all the desirable characteristics of cryptocurrencies, in addition to a legal and regulatory framework. Unlike major cryptocurrencies, CBDCs would have the backing of a Central Bank reserve which means that they would hardly ever fall to zero value.

Being blockchain-based, CBDCs enjoy obvious advantages like faster, cheaper transactions and far fewer transaction down-times. CBDCs are also a sublime way to capture the unbanked population in modern populations, who are yet to register onto the current ‘commercial bank’ financial system.

Technological advancement aside, CBDCs still stand the risk of abuse from centralized authority, as we have seen happen with Fiat currencies. Nothing will stop the Central Banks, for instance, from passing negative rates or repressive monetary policy on to the holders of these CBDCs.

<a href="https://medium.com/media/746470938938f6224c88a2e0e22ba64e/href">https://medium.com/media/746470938938f6224c88a2e0e22ba64e/href</a>

CBDCs As A Centralized Totalitarian Tool

Place a well-executed CBDC program in the hands of a totalitarian regime, for instance, and we are back where we started before cryptocurrencies, if not worse. Such a regime would essentially have access to every small business and individual’s ‘wallet’

Not only would such a regime be able to control the CBDC, but it might also make it such that the tokens are accepted in only a list of accepted businesses, or for a select list of products or for any reasons that the regime finds fit.

Besides, centralized CBDC systems are much more susceptible to collapse than decentralized CBDC systems, if such a term can exist.

A government-backed CBDC would see all transactional user data hosted under centralized control, violating the principle of decentralization observed by the best blockchain systems.

CBDC Potential Benefits

Potential benefits for CBDCs are that they will maintain relatively stable prices as they are backed by a Central Bank. It is highly unlikely that the government would watch its own issued CBDC go down to zero.

Once populations understand the benefits inherent in government-backed CBDC tokens, it might be easier for many to then see the benefits offered by decentralized currencies. CBDCs might therefore end up aiding mass crypto adoption.

To the extent that CBDCs are hosted on a blockchain, they are similar to cryptocurrencies. However, the key difference is that CBDCs would typically be hosted on a permissioned, centralized private government blockchain. Whoever owns the blockchain basically retains centralized control of the CBDC and can manipulate the system however they deem fit.

Why CBDCs?

A well-executed CBDC has the potential to ease a country’s public payment system, increasing efficiency and saving the public funds in lower transaction costs. CBDCs will give well-meaning governments a fighting chance against corruption, money laundering and wastage of public funds would suffer if launched effectively.

It would also be much easier for the government to implement a monetary policy like a stimulus program or to distribute relief funds to the people via a blockchain, compared to sending out stimulus checks via the postal service.

Directly issued CBDCs also enjoy advantages in financial inclusion, as they help capture the unbanked in society who are currently locked out of the financial system. Incumbent middlemen and gatekeepers i.e. banks and financial institutions have introduced bare minimums and bottlenecks that have seen portions of the population locked out of the traditional financial system.

To qualify for a bank account means that one must have accompanying documents, a clean credit record, and perhaps a minimum balance. Compare this to CBDCs where the only requirement would be a working internet connection and a mobile device through which to receive the government tokens.

Some Challenges for CBDCs to Solve

By issuing CBDCs governments will disintermediate traditional banks and financial institutions. Aside from the economic and political backlash, Central Banks must devise ways to sustain such institutions and rescue the sector from collapse.

Smartphone penetration across many third-world societies is still low. This brings to question exactly how much penetration CBDCs would achieve among the masses, being a digital currency.

Valid concerns exist regarding the extent of censorship an authoritarian regime would be able to exercise using a CBDC program. Oppressive governments could quite easily levy heavy taxes through the CBDC system, or implement discriminatory or corrupt monetary policy.

Types of CBDCs

1. Wholesale CBDCs — these will be financial instruments available for the bank to bank and large financial institution transactions

2. Retail CBDCs — these will be available to the general public, individual, and business users

About Benkiko Finance.

Benkiko is a digital first payments wallet enabling you to make instant micropayments across the world. With a key eye for the Digital Economy, Benkiko looks to power online shops, content creators and freelancers with faster settlements from literally anywhere in the world.

Using the power of blockchain, Benkiko uses the Benkiko USDB stablecoin to facilitate transfer of value/funds in an instant at near zero fees to 54+ currencies.

Read our previous blog; How to make a deposit on Benkiko.

Follow us on social media: Facebook || Twitter || Instagram|| Telegram ||